|

Getting your Trinity Audio player ready...

|

Introduction by Nick Sasaki

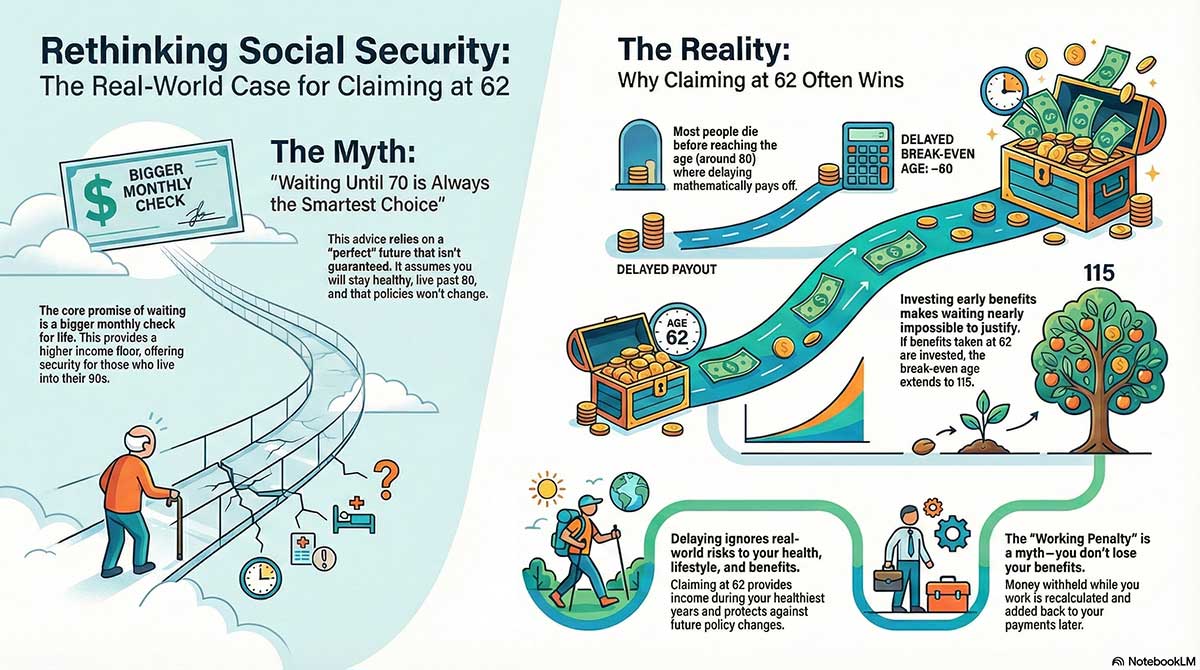

Welcome to this series of conversations on one of the most misunderstood financial decisions in America: when to take Social Security. For decades, people have been told that delaying benefits until age 70 is the ‘smart’ or ‘disciplined’ choice — a message repeated in seminars, financial newsletters, and polite dinner-table conversations.

But as we’ve learned across these six discussions, there is far more beneath the surface. The decision isn’t simply about getting a larger monthly check.

It’s about life expectancy, opportunity cost, system risk, health realities, personal values, and most importantly, living well today rather than gambling on a tomorrow that may or may not come.

Throughout these conversations, we’ve brought together three distinct voices:

- Tyler, who champions taking benefits at 62.

- Jordan, who initially believed strongly in waiting until 70.

- Casey, standing in the emotional and practical middle ground.

Together, they have unpacked the myths, the psychology, and the math behind this decision. And with the addition of Topic 6 — built on real CFP calculations — we confront the numbers that cut through the noise:

- The break-even age that most Americans never reach.

- The investment advantage that makes waiting nearly impossible to justify.

- The looming solvency challenges that introduce real political and financial risk.

- And the truth behind the most persistent misconception: the earnings test does not cause you to permanently lose benefits.

This is a conversation about clarity, realism, empowerment, and choice.

Not the idealized world of guaranteed longevity and perfect political cooperation, but the world real Americans actually live in.

Let’s begin.

(Note: This is an imaginary conversation, a creative exploration of an idea, and not a real speech or event.)

TOPIC 1: Should You Take Social Security at 62 or Wait Until 70?

Jane (Moderator) — Setting the Stage

“Every retiree faces the same crossroads: take Social Security early or wait for a larger check? Today, we’re bringing together three perspectives. Tyler, a former advisor who is choosing 62; Jordan, who plans to delay until 70; and Casey, who’s leaning toward claiming as soon as it’s available. Let’s dig into the real math, emotions, risks, and realities behind the choice.”

QUESTION 1

“What’s the real reason you chose your start age — and not the reason people think they’re supposed to give?”

Casey (62-taker)

“Honestly? I want the money while I’m healthy enough to enjoy it. I watched two coworkers put off retirement, planning to travel ‘later,’ only to face health issues that made later impossible. Why would I gamble like that? And it’s not just emotional — five extra years of payments is real money. People act like that doesn’t count.”

Jordan (70-waiter)

“For me, waiting isn’t about squeezing every dollar; it’s about security. I grew up poor. The idea of a bigger guaranteed check later gives me a sense of stability. If I live into my late 80s or 90s — and my family tends to — I want that higher income floor. So my reason is psychological as much as mathematical.”

Tyler

“My real reason? Control. I don’t want the government holding my benefit hostage until 70 like a pot of gold at the end of a rainbow I may never reach. Taking at 62 gives me flexibility. And after running thousands of retirement simulations, I can tell you: most people don’t hit the breakeven age where delaying mathematically wins. So I’d rather take the guaranteed income now.”

Jane (Moderator)

“What I hear is this: none of you are making your choice based solely on the monthly check. You’re making it based on lifestyle, health expectations, and risk tolerance — the factors most advice columns never talk about.”

QUESTION 2

“People argue endlessly about the math. But what number or fact actually changed your mind?”

Tyler

“The breakeven point. For most people, waiting until 70 only beats taking at 62 if they live past 80. But the average male dies at 82, female at 85 — and that’s at age 65, meaning many don’t make it. When your breakeven sits right up against your life expectancy, the math favors taking it earlier.”

Casey

“For me, it was realizing the earnings penalty isn’t a penalty. Everyone says, ‘If you work and take Social Security early, they take your money!’ No, they withhold it temporarily and recalibrate later. Once I understood that, the fear tactics disappeared.”

Jordan

“The fact that delaying increases the check by about 8% per year after full retirement age. That’s a return you can’t guarantee in the market. And the COLA adjustments start from that higher base. For someone with my longevity expectations, that’s powerful.”

Jane (Moderator)

“So the pivot points were:

- breakeven age (Tyler)

- misunderstanding the earnings adjustment (Casey)

- extraordinary delayed credits (Jordan)

Interesting — each of you latched onto different ‘aha!’ numbers. That’s exactly why blanket advice fails people.”

QUESTION 3

“If someone came to you today asking, ‘Should I take it at 62 or wait?’ — what’s the real advice you’d give?”

Jordan (70-waiter)

“I’d say: check your health, your genetics, and your budget. If you expect a long life and don’t need the income, waiting can give you peace of mind later. But I’d never tell someone to wait just because. That’s where people get misled.”

Casey (62-taker)

“I’d ask: what does your life look like right now? If the income frees you from stress, lets you retire earlier, or protects your savings during bad market cycles, take it. Most people underestimate how much earlier income improves their retirement quality.”

Tyler

“My advice is simple:

If taking at 62 makes your life better — financially or emotionally — do it.

People forget: Social Security is insurance, not a casino. You insured your retirement for decades. Claiming early means you use what you paid for. And based on national mortality data, policy risks, market volatility, and the true math — most people come out ahead by not delaying.”

Jane (Moderator) — Closing Reflection

“All three of you highlight something critical: the smartest claiming strategy isn’t just about age — it’s about reality. Your real life. Your real risks. Your real needs. Not the theoretical perfect outcome financial textbooks imagine.”

STRONG CONCLUSION — Jane’s Final Words

“When you put it all together, the message becomes clear:

Taking Social Security at 62 is not a mistake — for many Americans, it’s the optimal, rational, financially sound decision.

It provides:

- guaranteed income during your healthiest years

- protection from market downturns

- reduced strain on your personal savings

- insulation from future policy changes

- and a far greater chance of receiving the benefits you spent your life earning.

Waiting until 70 only pays off if life unfolds perfectly.

Taking it at 62 pays off in the world we actually live in.”

TOPIC 2: Is Delaying Social Security Really Worth the Risk?

Jane — Opening the Conversation

“Most people hear the same line over and over: ‘Delay until 70 and you’ll get the biggest check.’ But getting a bigger check doesn’t always mean getting a better outcome. Today I want to explore whether delaying is actually worth the risks people rarely talk about. Let’s look beyond the slogans and into the real-life consequences.”

Jane — First Question

“When people say ‘wait until 70,’ what hidden assumptions do you think they’re making?”

Tyler

“They’re assuming life is predictable. That you’ll stay healthy, live past 85, keep working without burnout, avoid medical surprises, and that Social Security rules won’t change. That’s a long list of perfect conditions. If any of those fall apart, delaying becomes a losing bet. I’ve sat with many retirees who regretted waiting because life didn’t unfold the way their financial models said it would.”

Jordan

“I think people assume the future will resemble the past — steady COLAs, stable policy, and a long healthy lifespan. As someone who is waiting, I admit I’m making those assumptions myself. My parents lived into their 90s, so in my mind, longevity is almost guaranteed. But I also know that’s not the norm for everyone.”

Casey

“I think the biggest assumption is that you’ll even want to wait. People talk like delaying is no big deal — but for a lot of us, those eight years from 62 to 70 feel long. That’s nearly a decade where people want to retire, rest, or enjoy life. Saying ‘just wait’ dismisses the emotional and physical cost of postponing freedom.”

Jane

“That’s insightful. People often assume a level of control over health, work, and policy that real life doesn’t always support.”

Jane — Second Question

“What risk do you think most people underestimate when deciding whether to delay their benefits?”

Casey

“Health risk. Not catastrophic illness — just the slow decline most people experience. You don’t need to be dying for your plans to fall apart. A bad knee, heart fatigue, chronic pain… those things can make travel or hobbies impossible. People imagine they’ll be golfing and traveling at 75, but many won’t. Taking benefits earlier lets you enjoy the money while your body still lets you.”

Tyler

“Longevity risk cuts both ways, but I think the risk of not living long enough is far more underestimated. The breakeven age for delaying is around 80. The average man only lives to 82 and the average woman to 85 — and that’s assuming you’re already 65. Statistically, millions never reach the age where delaying pays off. People think postponing is safer, but mathematically, early claiming is the safer play for the majority.”

Jordan

“I’ll speak from the opposite side. The risk I worry about is running out of money in my late 80s or 90s. I don’t want to be old, alone, and financially strapped. For me, delaying is protection against that scenario. But I admit, it’s still a gamble — I’m betting on myself living long, and that’s far from guaranteed.”

Jane

“Good. We often talk about investment risk but almost never about lifestyle risk, health risk, or emotional risk — yet those are the ones retirees feel most.”

Jane — Third Question

“Let’s imagine someone is 62 today and stuck between the two paths. What do you think they should consider before choosing?”

Jordan

“I’d tell them to look at three things:

Family longevity

Their current savings

Whether they actually enjoy their work

If you have a family history of long life, a comfortable nest egg, and a job you don’t mind keeping, delaying might be a strong option. But if work is draining or your health is declining, forcing yourself to wait can cause more harm than benefit.”

Tyler

“I’d ask them a different set of questions:

Are you financially stable enough to enjoy life now?

Do you want guaranteed income while you’re healthiest?

Are you relying on perfect outcomes to make delaying work?

If the answer is yes to the first two and no to the third, taking it at 62 is likely the better choice. People forget that Social Security is insurance — not a prize you win for surviving to 70.”

Casey

“I’d ask them to imagine two futures. In one, you wait and hope things go perfectly. In the other, you take the benefit early, reduce financial stress immediately, and start enjoying life. Which future feels more like real life, and which feels like a fantasy? Most people know the answer deep down.”

Jane

“Interesting how each of you frames the decision differently — but all of you agree that personal reality is more important than generic advice.”

Jane — Closing Reflection

“Social Security decisions aren’t made in spreadsheets — they’re made in real lives, full of uncertainty, hopes, fears, and imperfect information. Delaying until 70 might sound smart mathematically, but it comes with significant risks: lifespan uncertainty, policy risk, health changes, job market shifts, and the emotional cost of postponing enjoyment.

When you zoom out, the argument that truly stands out is Tyler’s: delaying works only if life goes perfectly. But taking benefits at 62 works in the real world most people live in — unpredictable, imperfect, and human.”

TOPIC 3: How Do Emotions Shape the Social Security Decision More Than Math?

Jane — Opening the Conversation

“We often pretend Social Security is a purely mathematical decision. Charts, breakeven points, actuarial tables… and yet, most people decide with their emotions first and justify it with numbers later. Today I want to explore the emotional side — the fears, the hopes, and the lived realities — that truly drive whether someone takes benefits at 62 or waits until 70.”

Jane — First Question

“What’s the emotional factor you think people underestimate the most when deciding when to claim?”

Jordan

“Fear. People don’t like to admit it, but delaying takes emotional courage. You’re choosing not to take money you’re entitled to, trusting that you’ll survive long enough to make that choice pay off. And for many, fear of financial scarcity later in life is very real. That fear can push someone toward delaying even when the math doesn’t fully justify it.”

Casey

“I think people underestimate the emotional weight of wanting to stop worrying. When that check starts coming in at 62, there’s a sense of relief — like a pressure valve releasing. The idea that you finally have a guaranteed income stream after a lifetime of working is emotionally stabilizing. That’s not something spreadsheets can measure.”

Tyler

“The emotional factor people underestimate most is regret — specifically, the regret of waiting too long. I’ve heard dozens of stories from clients who put off claiming and then faced health decline, layoffs, or life changes that made their plans collapse. They said things like, ‘I should’ve taken it earlier.’ Regret hits harder than fear. To me, taking it at 62 minimizes that regret risk.”

Jane

“So we have fear, relief, and regret — three powerful emotional forces that can override even the best mathematical planning.”

Jane — Second Question

“How does your personal background influence your decision?”

Casey

“I grew up in a family where nothing was guaranteed. Factory layoffs, medical bills, debt — we never had the luxury of ‘waiting for later.’ That upbringing makes me suspicious of delayed promises. If something is available now, you take it. That’s not irresponsibility; that’s lived experience. So yes, my upbringing makes taking it at 62 feel like the practical choice.”

Tyler

“I spent years as an advisor watching people’s plans fail not because they miscalculated the math, but because life disrupted their strategy. That experience shapes everything. I’ve seen people wait for that ‘perfect’ delayed check only to have sickness, market downturns, or unexpected costs derail them. So my background taught me this: front-load your certainty.”

Jordan

“My background is the opposite. My parents lived long lives, saved diligently, and valued security above all else. They weren’t wealthy, but they believed in building a foundation that would last into their 80s and 90s. Because I saw that work for them, I naturally lean toward delaying. It’s not just a math choice — it’s a cultural one I inherited.”

Jane

“That’s important. Our Social Security decisions aren’t just financial — they’re shaped by family history, class background, emotional memory, and even cultural inheritance.”

Jane — Third Question

“If someone told you they feel emotionally overwhelmed by this decision, what would you say to help them think clearly?”

Tyler

“I’d tell them to stop thinking about the ‘perfect’ decision and focus on the safe decision. The safe decision is the one that works even if life doesn’t go perfectly. For most people, that’s taking it early. Don’t overwhelm yourself with theoretical outcomes — ground yourself in your lived reality.”

Jordan

“I’d encourage them to think about which version of themselves they’re trying to protect:

The version at 62 who might enjoy life more today

orThe older version at 85 who may need more income later.

You’re choosing which self gets priority. Once you know who you’re protecting, the decision becomes clearer.”

Casey

“I’d ask them to imagine how they’ll feel in both scenarios:

How will you feel if you take it now?

How will you feel if you wait and something unexpected happens?

One of those feelings will be heavier in your chest. Go with the choice that brings a sense of peace — not the one that satisfies other people’s opinions.”

Jane

“I appreciate how each of you brings empathy to the decision. People often struggle not because the math is hard, but because the emotions are heavy.”

Jane — Closing Reflection

“What we’ve uncovered today is simple but profound: the Social Security decision isn’t a battle between good math and bad math — it’s a negotiation between hope and fear, between dreams and realities, between the person you are today and the older person you imagine becoming.

For many Americans, the emotional cost of waiting is higher than the financial reward. Receiving benefits earlier provides stability, freedom, and the chance to use the income while life is at its richest. Delaying only works if everything unfolds smoothly — and that’s rarely how life behaves.

Emotionally and practically, most people do better when they choose certainty over possibility. And that certainty often begins at age 62.”

TOPIC 4: What If You’re Still Working? Does Taking Social Security Early Still Make Sense?

Jane — Opening the Conversation

“One of the most confusing parts of early Social Security is the earnings rule. People hear, ‘If you work and take benefits before full retirement age, they take money away,’ and that scares them into delaying. But as we know, the rule is badly misunderstood. Today, we’re going to explore what really happens when you take Social Security at 62 while still working — and whether it's still a smart move.”

Jane — First Question

“Why do you think the earnings rule scares people so much, and what do most people misunderstand?”

Casey

“Because it’s framed like a punishment. People hear, ‘One dollar for every two dollars over the limit is taken away,’ and they imagine losing money forever. But it’s not a penalty — it’s an adjustment. The benefits are withheld temporarily and added back later. Once I realized that, the fear evaporated. The government’s terrible at messaging, so the rule sounds scarier than it is.”

Tyler

“The misunderstanding is intentional in a way. Seminars, articles, and even advisors repeat the same scary phrasing because it pushes people into the ‘wait until 70’ mindset. And the truth is, hardly anyone explains that the withheld amount is recalculated and credited back at full retirement age. When I tell people, they look shocked — they’ve been misled for years.”

Jordan

“I admit, the rule influenced me too, even though I’m planning to wait. It sounds punitive. And I think people react emotionally: they hear the word ‘lose’ and shut down. In reality, it’s more of a timing issue than a loss. But phrasing matters, and in this case, the messaging has created unnecessary fear.”

Jane

“That’s such an important insight: people are reacting to the language, not the actual financial impact.”

Jane — Second Question

“If someone is still earning income at 62, what are the real advantages of taking Social Security early anyway?”

Tyler

“There are several. First, it reduces portfolio pressure. If you’re drawing Social Security, you don’t need to pull as much from savings. That leads to fewer withdrawals in market downturns — which is one of the biggest retirement risks. Second, you lock in five to eight years of income that you may never get if you wait. Third, you get a recalculation at FRA that often results in a higher future check than the early-claiming charts show.”

Jordan

“I think the main advantage is simply flexibility. Even if you don’t need the money, having more income gives you options:

work fewer hours

transition into part-time roles

start a business

take care of aging parents

People underestimate how empowering that flexibility can be.”

Casey

“For me, it’s lifestyle stability. Working in your 60s is not the same as working in your 40s. Energy dips. Stress accumulates. Health becomes unpredictable. If Social Security income gives you the ability to slow down without fear, it’s worth its weight in gold. And again, the earnings rule doesn’t erase the benefit — it just shifts some of it into your future checks.”

Jane

“So the real advantages aren’t just financial — they’re about quality of life, autonomy, and reducing risk.”

Jane — Third Question

“What would you say to someone who’s 62, still earning decent money, and feels torn between claiming now or waiting?”

Casey

“I’d ask them what they want their life to feel like over the next decade. If they’re exhausted, stressed, or craving more time, taking Social Security can create breathing room. And even if some of the benefit is temporarily withheld, the freedom they gain right now often outweighs the theoretical gains of waiting.”

Tyler

“I’d encourage them to run both paths emotionally, not just mathematically.

Path A: You take benefits at 62, work less, save your portfolio, enjoy life now.

Path B: You delay until 70, work longer, and hope your health and job hold up.

Which path feels more aligned with the life they actually want to live?

For most people, the answer becomes obvious when they picture their real day-to-day life.”

Jordan

“My advice would be: look at your actual need. If your income is strong, and the idea of a larger guaranteed check later genuinely comforts you, waiting may be right. But don’t wait just because a chart says you ‘should.’ And don’t ignore the fact that the earnings rule doesn’t actually take away anything long-term.”

Jane

“So your message is: think about your life circumstances — not blanket advice, not fear-driven headlines, not generic charts.”

Jane — Closing Reflection

“What we’ve uncovered today is vital: the earnings rule is one of the most misunderstood features of Social Security. It frightens people away from claiming early when, in reality, it shouldn’t. The withheld benefits aren’t lost — they’re deferred, recalculated, and returned in the form of higher payments later.

And more importantly, early claiming provides real, tangible benefits for people who are still working:

less reliance on volatile investments

more control over workload

increased lifestyle flexibility

reduced stress during a life stage when stability matters most

Delaying until 70 is only superior in a scenario where health, employment, longevity, and policy all cooperate perfectly. But the world rarely gives us perfect conditions.

For many who are still working at 62, the smarter, safer, more human choice is to claim now, enjoy the income, reduce financial pressure, and allow Social Security to do what it was designed to do — support your life, not restrict it.”

TOPIC 5: What Matters Most: Living Well Now or Planning for a Perfect Later?

Jane — Opening the Conversation

“We’ve talked about math, emotions, longevity, risk, and working while claiming. But at the heart of this debate lies a deeper human question: What matters more — maximizing your Social Security check or maximizing your life? Today, I want to explore that balance. Not the numbers, but the philosophy of retirement itself.”

Jane — First Question

“When you picture someone who waited until 70 versus someone who took it at 62, what differences in lifestyle do you imagine?”

Tyler

“I imagine the person who waited needing everything to go right. Their health, their job, their savings — all of it. Waiting until 70 is a strategy that assumes a perfect run. Meanwhile, the 62-taker is already living their life. They’re traveling, seeing their grandkids more often, or simply breathing easier because they’re not dependent on market returns or job stability. The lifestyle difference is that one is planning for an idealized future while the other is enjoying a guaranteed present.”

Jordan

“When I picture someone who waited until 70, I imagine someone who wants to secure their late-life years. They might be living more cautiously in the early 60s, but they’re thinking about being 90 and still having income. For the 62-taker, I imagine more freedom early on — but potentially more budgeting later. Different choices, different trade-offs.”

Casey

“I imagine someone who waited at 70 still stuck in the grind during their 60s. Working longer, saving more, hoping everything stays stable. The 62-taker? They’re already in Chapter Two of their life. They’ve turned the page. And honestly, for most people, the quality of life in your 60s is miles ahead of what your 80s will feel like. Why not enjoy that window?”

Jane

“So the difference isn’t income — it’s lifestyle timing. One lives earlier, one saves for later.”

Jane — Second Question

“Retirement isn’t really about money — it’s about meaning. How do you think taking Social Security early or late changes someone’s sense of purpose?”

Casey

“When you take it at 62, you often gain space — mental space, emotional space, creative space. Suddenly you’re not just working to survive. You can pursue hobbies, passion projects, travel, or simply rest. You reclaim time, which is the most valuable currency.”

Tyler

“I’ve seen early Social Security open doors for people who never imagined they’d have options. Some start part-time businesses. Some volunteer. Some reconnect with family. Taking benefits early often leads to a sense of empowerment. Delaying can sometimes feel like deferring your life — postponing your purpose until a safer future that may never come.”

Jordan

“I’ll offer the counterpoint — waiting can also give a sense of purpose. Some people genuinely like working. They enjoy routine, structure, contribution. They feel more secure knowing they’re building a stronger financial foundation. For them, delaying isn’t about suffering; it’s about maintaining meaning.”

Jane

“That’s a valuable distinction. Retirement choices aren’t just financial — they shape who you become during that chapter of life.”

Jane — Third Question

“If you had to give one final piece of advice to someone torn between 62 and 70, what would you tell them to think about?”

Tyler

“I’d tell them this: life doesn’t wait for 70. Your healthiest, most active, most independent years are usually in your 60s — not your 80s. Social Security was designed as insurance, not a jackpot. Use it when it improves your life the most. For many people, that’s at 62.”

Jordan

“I’d say: focus on which scenario makes you feel more secure. Some people feel calmer with money coming in now. Others feel safer with a bigger check later. Choose the option that reduces anxiety, not the one that impresses advisors or follows generic charts.”

Casey

“I’d say: imagine looking back from age 85. Which decision would you regret more — taking it early or waiting too long?

Most people realize they fear missing out on life far more than they fear missing out on a larger check.”

Jane

“That question — regret — is often the clearest guide of all.”

Jane — Final Reflection

“What has become clear over these five conversations is this: the Social Security decision is not actually about maximizing money. It’s about maximizing life.

We’ve seen that:

Waiting until 70 only works if life cooperates perfectly.

Most Americans statistically won’t reach the breakeven point where delaying wins.

Health, work, markets, and policy all pose real risks.

The emotional benefits of early claiming — relief, freedom, reduced stress — have enormous value.

And taking benefits at 62 often improves quality of life during the decade when you’re healthiest and most capable of enjoying it.

Retirement is not a puzzle to solve; it is a life stage to live.

For the majority of people, claiming Social Security at 62 is not a mistake —

it is the choice that aligns with real life, not idealized projections.

It gives you time.

It gives you options.

It gives you control.

And most importantly, it gives you the opportunity to live fully now, not later.”

Topic 6: Is Waiting Until 70 a Gamble You Can’t Win? The Math, Mortality, and Solvency Reality Check.

Moderator: Jane Bryant Quinn

Jane — Opening the Conversation

“In our previous discussions, we explored the emotional, financial, and lifestyle dimensions of taking Social Security early versus delaying. But today, I want to bring something new to the table: real calculations from a Certified Financial Planner. Numbers that don’t just suggest taking Social Security at 62 — they challenge the very logic behind waiting.

We are going to examine three powerful data points:

break-even age, the investment alternative, and Social Security solvency. These numbers don’t care about opinions or preferences. They tell their own story. And I’m eager to hear how each of you responds to them.”

Jane — First Question

“Let’s begin with break-even age. If someone doesn’t break even until age 79 — but the average American dies at 78 — what does that mean for this entire debate?”

Tyler

“It means the debate is largely an illusion. Break-even age is supposed to be the point where delaying ‘pays off.’ But if that point sits beyond average life expectancy, then the strategy fails for most Americans before they ever reach the payoff. It’s like buying a winning lottery ticket that only pays if you live long enough to cash it in — and statistically, most people won’t.”

Casey

“This is the part that hit me hardest. We talk about break-even like it’s neutral math, but it becomes real when you compare it to how long people actually live. If the average American doesn’t reach the age where delaying wins, then delaying becomes a luxury only a small percentage can afford. The math isn’t just numbers — it’s reality.”

Jordan

“I’ve always been comfortable with the breakeven concept because of my family’s longevity. My parents lived into their 90s. But hearing this in the context of national averages… it does make me question whether I’ve been assuming too much. Not everyone has the genetics or the health stability I’ve relied on.”

Jane

“Break-even only matters if you break even. And most retirees never do. That’s a crucial distinction.”

Jane — Second Question

“Now let’s look at the more shocking calculation: If someone takes Social Security at 62 and invests it at a conservative 7% return, the breakeven age doesn’t arrive until about age 115. Only three Americans in history have lived that long. How does this change the conversation?”

Tyler

“It exposes the illusion behind the whole ‘wait for a bigger check’ mindset. If you invest early benefits — even modestly — the compounding effect annihilates the value of waiting. You would need superhuman longevity to catch up. This is the math no one talks about, because it makes the delay-until-70 advice look absurd for most people.”

Casey

“It makes me feel like waiting is almost a fantasy. Most of us aren’t living to 90, let alone 115. Meanwhile, those invested payments could be growing for ten or twenty years. It flips the logic: waiting becomes the riskier choice.”

Jordan

“I’ll admit… this one is uncomfortable. I’ve always believed in delaying to maximize guaranteed income. But this calculation hits hard because it shows that the opportunity cost of waiting isn’t just theoretical — it’s massive. I’ve always trusted the idea of building a larger benefit, but I never compared it against compounding returns. It’s… humbling.”

Jane

“That’s why I brought it up. Retirement planning is always about opportunity cost — and this data point makes the opportunity cost of waiting staggeringly clear.”

Jane — Third Question

“Finally, let’s talk about solvency. Social Security’s own projections show a 20% benefit reduction starting in 2034 unless Congress takes significant action. In your view, how should the possibility of policy instability influence someone’s claiming decision?”

Casey

“To me, this is the nail in the coffin for waiting. You’re telling people to delay for up to eight years, only to risk getting less than expected? If the system is strained, the safest move is to claim early and secure what you can. Betting on politicians to fix anything on time feels reckless.”

Tyler

“This is the part that pushed me firmly into the 62 camp. The idea that someone would wait until 70 — only to end up with a reduced benefit because Congress didn’t act — feels like a betrayal waiting to happen. Early claiming protects you from political risk. The system is already warning us. We’d be foolish not to listen.”

Jordan

“I’m still trying to process this. I’ve always believed that Congress would fix Social Security because letting it fail is unthinkable. But after the last decade of gridlock… I can’t say that with confidence anymore. This adds a layer of risk I never accounted for. It does make waiting feel less certain.”

Jane

“Social Security is stable enough to trust, but not so stable that you should ignore its warnings. Policy risk is real, and it affects the timing decision more than most people realize.”

Jane — Closing Reflection

“What we’ve discussed today goes beyond emotion, beyond preference, and beyond habit. These three numbers — break-even age, investment returns, and solvency projections — challenge the entire cultural assumption that delaying Social Security is the ‘smart’ or ‘disciplined’ choice.

What we see instead is a system where:

Most people die before the delay pays off.

Investing early benefits dramatically outperforms waiting.

Political uncertainty introduces genuine downside risk to delaying.

And the earnings-test misconception continues to confuse millions, despite the truth: withheld benefits are paid back at full retirement age.

When you put these together, the message is unmistakable:

Taking Social Security at 62 isn’t just reasonable.

It’s rational.

It’s protective.

It’s mathematically superior for most Americans living in the real world — not the idealized projections of a perfect future.

Retirement is not about hoping life lines up perfectly.

It’s about securing your freedom while you have the time and health to enjoy it.”

Final Thoughts by Nick Sasaki

As we conclude this six-part journey, one truth rises above all the charts, emotions, fears, and long-standing beliefs:

The best Social Security decision is the one that protects your life today, not the one that gambles on a future you may never reach.

For decades, people have been conditioned to believe that delaying benefits is a badge of wisdom — that waiting until 70 is the ‘responsible’ path. But when we peel back that narrative and examine the real math and real-world data, a more balanced picture emerges.

Across these conversations, we have seen that:

- Most retirees will not live long enough for delaying to pay off.

- Investing early benefits dramatically outperforms waiting, unless someone expects to live beyond 110 years old.

- Solvency concerns create uncertainty that disproportionately affects late claimers.

- Those who continue working at 62 do not lose benefits permanently — a truth too rarely explained.

- The emotional freedom of having income earlier often outweighs the theoretical value of waiting.

But perhaps most importantly, we learned that Social Security is not just a financial calculation.

It’s a life calculation.

It’s about recognizing that joy, health, mobility, and time are not guaranteed.

It’s about removing pressure, reducing fear, and gaining agency.

It’s about enabling the years you have rather than structuring your life around years you hope for.

And so, after exploring every angle — practical, mathematical, psychological, and political — we arrive at a grounded conclusion:

Taking Social Security at 62 is not only a rational choice for many Americans…

it is often the choice that maximizes freedom, security, and the real human experience of retirement.

The goal isn’t to win an argument.

It’s to empower people to make choices that support the life they want today — not the life someone else told them to wait for.

Thank you for joining us in this exploration.

May your financial decisions support your life, your joy, and your peace — starting now.

Short Bios:

Jane Bryant Quinn

Jane Bryant Quinn is one of America’s most respected personal finance journalists, known for her decades of clear, practical guidance on retirement planning, investing, and financial security. Her work has appeared in Newsweek, The Washington Post, CBS News, and multiple bestselling books that have helped millions navigate money with confidence.

Tyler

Tyler is a former financial advisor and portfolio manager who left the industry to provide free, transparent financial education. With years of experience analyzing retirement outcomes, he advocates for practical, real-world Social Security strategies rooted in risk awareness and quality-of-life considerations.

Jordan

Jordan is a lifelong saver with a strong family history of longevity, shaping his preference for delaying Social Security until age 70. His background in data analytics influences his methodical approach to financial decisions, prioritizing long-term stability and security in later life.

Casey

Casey represents millions of everyday Americans making retirement decisions based on real-life pressures rather than abstract models. Growing up in a working-class family, Casey values financial relief, emotional well-being, and the freedom to enjoy retirement early, leading toward claiming Social Security at 62.

Leave a Reply