|

Getting your Trinity Audio player ready...

|

Jane Bryant Quinn:

If you’re nearing retirement, you’ve probably asked yourself the question:

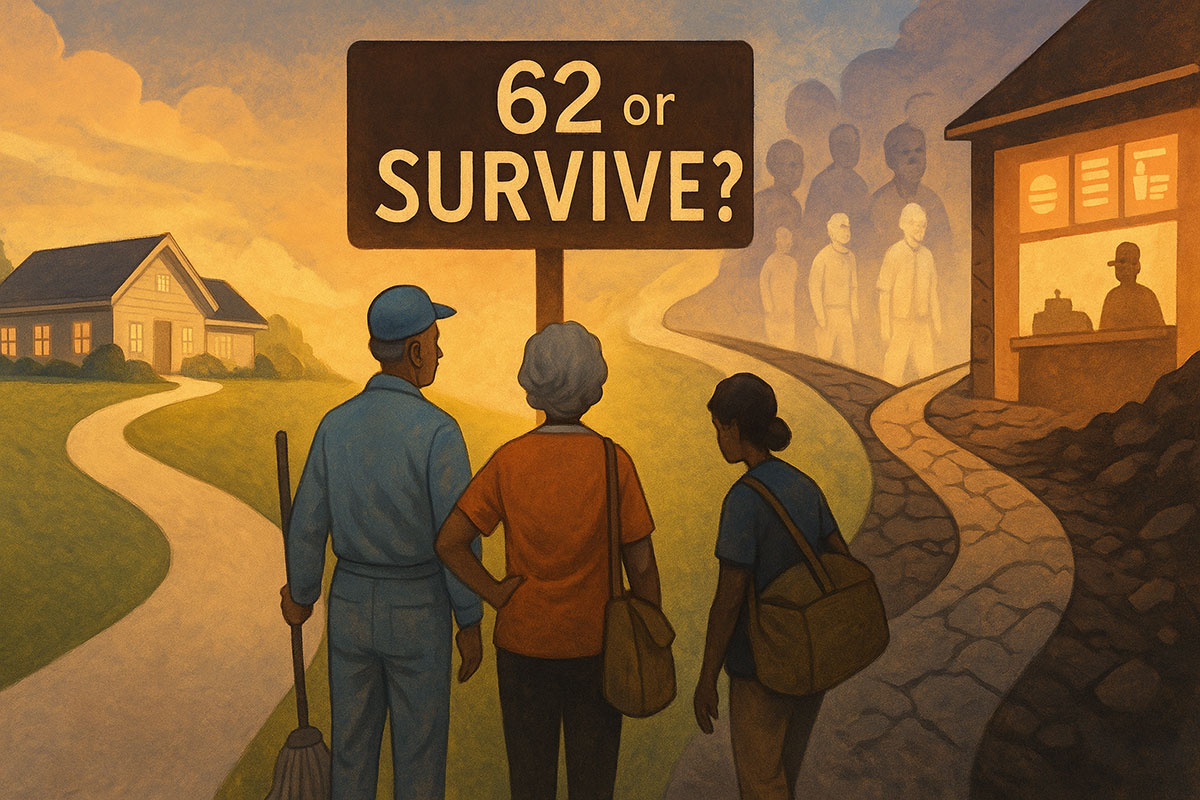

“When should I claim Social Security?”

It sounds simple—but it isn’t. Claim early, and you get money sooner—but less of it for life. Delay, and the check grows—but so does the wait. So how do you decide when to take Social Security in a way that actually fits your life—not just a chart in a retirement guide?

In this series, we’re going to walk you through the real questions—financial and emotional—that define this decision.

Should you claim at 62 or delay until 70?

Can low-income workers afford to wait?

Is your health and longevity part of the equation?

And perhaps the biggest question of all—Will Social Security still be there when you need it?

You’ll hear from economists, retirement experts, and behavioral voices who’ve studied this for decades. They won’t all agree—but that’s the point. Because this isn’t a one-size-fits-all system. It’s about making the best decision you can, with the life you have.

So whether you’re planning, worrying, or already choosing—this is for you. Let’s begin.

(Note: This is an imaginary conversation, a creative exploration of an idea, and not a real speech or event.)

Topic 1: Should I Claim Social Security at 62? The Real Emotional Cost

Moderator: Jean Chatzky – Financial journalist and empathetic guide for everyday Americans

Panelists:

Suze Orman – Personal finance educator

Ramit Sethi – Behavioral finance author

Daniel Kahneman – Behavioral economist (legacy voice)

Jean Chatzky – Moderator

Terri Trespicio – Emotional wellness speaker

Optional cameo: A retiree voice (e.g., “Linda,” a 63-year-old who claimed early)

🌟 Jean Chatzky (opening remarks)

Welcome, everyone. Today’s discussion is about one of the most emotionally charged decisions in personal finance: when to claim Social Security. For many, claiming early feels like safety. For others, it feels like giving up long-term security. But what's really driving those choices? Is it fear, pragmatism, or something deeper? Let’s unpack the human side of this decision.

💬 Jean: Many people claim at 62 not because it’s best financially—but because they’re scared. Is this a rational choice, or are people sacrificing long-term security for short-term relief?

Suze Orman

I’ve said it before—if you claim early out of fear, you're not gaining freedom, you're buying anxiety later. But I also understand that fear. If you’ve worked 40 years and you're tired, the idea of "waiting" feels cruel. Still, those who can hold out until 67 or 70 often feel more secure and free later in life.

Daniel Kahneman

Fear is not irrational—it's deeply human. People overweight immediate pain and undervalue long-term gain. Claiming early reduces uncertainty, not necessarily risk. From a behavioral standpoint, it gives a sense of control—even if mathematically it’s suboptimal.

Ramit Sethi

Most people don’t run the numbers—they run emotions. They say, “I want what I paid in,” or “I might not make it to 70.” That’s a scarcity mindset. But what if we asked a better question: “What kind of life do I want at 80?” Sometimes it’s less about the money and more about trusting the future.

Terri Trespicio

So often, the question isn't “Should I wait?” but “Am I allowed to wait?” We internalize guilt around rest, pleasure, and ‘not working.’ Especially for people raised to hustle nonstop, delaying can feel like selfishness. It's emotional baggage disguised as financial strategy.

Linda (Retiree Voice)

I took it at 62 because I was just done. I’d raised kids, buried my husband, and had health scares. It wasn’t about numbers—it was about peace. Looking back, I might have waited. But I needed breathing room.

💬 Jean: Is claiming early ever the emotionally healthier choice, even if it reduces income later?

Terri Trespicio

Absolutely. If someone is burning out, has caregiving responsibilities, or needs time to heal—emotionally or physically—early claiming can be an act of self-preservation. But it should be conscious, not reactive. Know what you’re trading.

Suze Orman

It depends on your “emotional ROI.” If you claim early and use the money to pay off debt, stabilize your life, and get grounded—then maybe it’s the right move. But if it’s driven by panic, not a plan, you’re just shifting fear into the future.

Daniel Kahneman

The regret that people often experience isn't about claiming early—it’s about doing so without understanding the consequences. Regret aversion can be minimized by helping people simulate future outcomes—like visualizing life at 75.

Ramit Sethi

I’d challenge people to ask: “If you didn’t know about the early option, what would you do?” Scarcity makes us obsess over ‘what ifs’ that may never come. Yes, there are exceptions. But emotionally healthy choices tend to come from vision, not fear.

Linda

I wish someone had asked me what I wanted my life to look like. I wasn’t thinking about 80. I was thinking about making it through the month.

💬 Jean: What tools, mindsets, or questions can help people make this decision with both confidence and clarity?

Ramit Sethi

Start by imagining your ideal day at age 75. Are you relaxed or stressed? Traveling or homebound? Then ask, “What gets me closer to that?” If claiming early supports that vision, do it. But if it undercuts it, reconsider.

Daniel Kahneman

Talk aloud. Use tools that simulate trade-offs visually. People make better decisions when they externalize the math and the story. This isn’t just about dollars. It’s about future identity.

Terri Trespicio

Ditch the guilt. You’re not bad for needing rest, nor are you greedy for wanting security. The right question is: “What would make me feel most whole 10 years from now?” That answer is wiser than any spreadsheet.

Suze Orman

Run your numbers. Then run your life. Think beyond just “survival” income. Ask: Can I delay at least one year? That’s one more year of increase. Even delaying from 62 to 63 can create meaningful change.

Linda

I’d say: Talk to someone who’s been through it. I didn’t know what I didn’t know. Having someone listen without judgment—maybe that’s the most powerful tool of all.

🌟 Jean Chatzky (final thoughts)

This decision isn’t just about numbers—it’s about how we imagine our future selves. Whether you claim early, at full retirement age, or wait until 70, do it with open eyes and an open heart. Don’t just ask what’s smart—ask what’s right for you. Fear might knock, but you don’t have to answer without clarity.

Topic 2: Is It Better to Delay Social Security for Longevity or Legacy?

Moderator: Christine Benz – Director of Personal Finance at Morningstar

Panelists:

Wade Pfau – Retirement income expert and risk strategist

Dr. Peter Attia – Longevity physician focused on lifespan optimization

David Sinclair – Harvard aging researcher and biotech innovator

Bill Bengen – Creator of the 4% rule in retirement planning

Jonathan Clements – Personal finance writer and founder of HumbleDollar

🌟 Christine Benz (opening remarks)

When deciding when to claim Social Security, there’s one gamble we all make—how long we’ll live. Do you prioritize a longer life and delay claiming, or grab your benefits early to ensure you can enjoy them at all? And how does your desire to leave a financial legacy shape your decision? Let’s unpack this deeply human and financial question: Do you claim for yourself—or for those you leave behind?

💬 Christine: Predicting your own lifespan is impossible, yet this guess affects a major financial decision. How should someone realistically factor longevity into their Social Security timing?

Wade Pfau

You’re not really guessing how long you’ll live—you’re planning for a risk. Delaying Social Security is a form of longevity insurance. It protects you from the scenario where you live a long life and outlive your portfolio. Even if you die early, your “loss” is just some unused income—but if you live long, delaying can prevent poverty in your 80s or 90s.

Dr. Peter Attia

Longevity isn’t just genetics—it’s agency. If you’re proactively managing your health—sleep, exercise, metabolic health—you’re likely to live longer than you think. I tell my patients: Don’t plan to die at 75. Plan to live to 95 and reverse engineer your financial timeline from there.

Jonathan Clements

I take a middle path. People hate the idea of “leaving money on the table.” But claiming early can actually be expensive if you live into your 90s. I often say: if you’re in reasonable health, plan for a long life—because you only get one chance to make the right call on Social Security.

David Sinclair

From a biological standpoint, the longevity curve is shifting. Advances in medicine, diagnostics, and lifestyle interventions mean that a 65-year-old today is not the same as one 30 years ago. If people are living longer, their financial assumptions need to catch up to that science.

Bill Bengen

I developed the 4% rule assuming a 30-year retirement. But for some retirees today, 35–40 years is more realistic. That changes everything. Claiming early might give peace now, but it can erode resilience later. It’s a math equation—yes—but also a life strategy.

💬 Christine: Some people want to maximize what they leave behind—especially to children or a surviving spouse. Should legacy goals affect when you claim?

Jonathan Clements

Absolutely. If you’re the higher earner in a couple, delaying Social Security can increase survivor benefits for your spouse. That is legacy planning. It’s not just about passing assets—it’s about passing income security to your loved ones.

David Sinclair

Legacy isn’t just wealth—it’s wellbeing. If you claim early and strain your later years, you may unintentionally become a financial burden. The best legacy might be not needing help. Longevity and legacy go hand-in-hand.

Wade Pfau

Legacy is more than leaving a large estate—it’s ensuring your family doesn’t have to make hard trade-offs. By delaying Social Security, especially if you’re healthy and have other income, you give your family greater stability—even if it means spending more now and leaving less later.

Bill Bengen

If leaving money is your top priority, then claiming early might make sense. But that assumes you can invest those funds wisely. Most people don’t. Social Security is guaranteed and inflation-protected. You’d need a very disciplined strategy to beat it through early claiming and investing.

Dr. Peter Attia

I’d argue: invest in a legacy of health literacy. Help your kids or spouse understand longevity and risk, not just inheritance. Social Security may seem small, but when timed right, it can make a big difference in the stability of those who come after you.

💬 Christine: With uncertainty so high, how can someone approach this decision with confidence instead of anxiety?

Bill Bengen

Don’t try to “beat” the system—build a system you can live with. That might mean delaying to 70 if you're healthy, or taking at full retirement age if you're on the fence. Either way, clarity reduces anxiety. Use models. Map scenarios. Choose deliberately.

Dr. Peter Attia

Focus on what you can control: your health, your spending, and your mindset. Financial resilience is partly biological. Plan to live. Train your body and your money for a long game.

Wade Pfau

Use what's called the breakeven analysis—the age at which delayed claiming “catches up” to early claiming. For most people, it's around 78–80. So if you think you’ll live past that, delay. That framework brings a lot of clarity and confidence.

David Sinclair

Think of aging as a curve, not a cliff. Most people will live longer than they fear. If we treated life after 80 with the same intentionality as our 40s or 50s, we’d stop fearing “running out.” Social Security should serve your whole timeline.

Jonathan Clements

Confidence comes from preparation, not prediction. Know your numbers, yes—but also your values. What’s more important to you: control now, or protection later? The answer will guide you far better than fear ever could.

🌟 Christine Benz (final thoughts)

The truth is—we don’t know how long we’ll live. But we know how to plan as if we’ll live. Delaying Social Security is a bet on yourself. And sometimes, the best legacy you can leave is a long, peaceful, well-funded life. So ask not just “How much do I get?” but “Who do I want to become in old age?” That’s the kind of clarity worth investing in.

Topic 3: Is It Better to Delay Social Security for Longevity or Legacy?

Moderator: Kara Swisher – Sharp, skeptical, and emotionally intelligent interviewer who knows how to push both practical and philosophical angles

Participants:

Morgan Housel – Money and time thinker, brings deep human insight

Ramit Sethi – Bold advocate of spending with joy

Dr. Laura Carstensen – Expert in aging and emotional priorities

Christine Benz – Anchor of structured financial strategy

Bill Perkins – Die With Zero champion, pushes the “no regrets” mindset

🌟 Kara Swisher (opening remarks)

Today we’re asking a very real, very human question:

What’s the point of saving all your life if you wait too long to actually enjoy it?

Many people reach retirement only to find their bodies slowing down and their friends disappearing. Some say, “Spend it while you can.” Others warn, “You might live to 95.”

So… should joy come early—or security come first? Let’s ask the people who’ve wrestled with this tension deeply.

💬 Kara: Is it smart to front-load joy and spend early, or is that just a risky form of denial?

Bill Perkins

If you die with a million dollars in the bank, and no memories of doing what you loved—did you really live? People over-save out of fear. But money is a tool for experience, not a trophy. Spend when your health and energy allow it. Later might be too late.

Christine Benz

It depends. If you’ve run your numbers and your basic needs are covered, spending more in your active years makes total sense. But I always tell people: plan with eyes open. You don’t want to be 85 and feel like your early joy came at the cost of dignity.

Ramit Sethi

Most people don’t have a “spending problem”—they have a permission problem. They don’t give themselves permission to enjoy what they’ve worked for. If you wait until everything is perfectly certain, you’ll never move. Spend with intention—not fear.

Morgan Housel

There’s a quiet tragedy in saving for decades and never using it. But I also believe in optional freedom. Early spending should be purposeful, not compulsive. Ask: What memory or experience will compound over time? Spend on those.

Dr. Laura Carstensen

Psychologically, older adults prioritize meaning, not material. They don’t regret missing a big purchase. They regret missing relationships, travel, or spontaneity. If your health allows, spend on what makes you feel alive while you still can.

💬 Kara: What’s the danger in spending too cautiously—or too quickly?

Ramit Sethi

Too cautious? You become the richest person in the cemetery. Too quick? You’re anxious every birthday after 75. The sweet spot is knowing your numbers and knowing your values. That’s freedom.

Morgan Housel

One risk is seeing retirement as a cliff: “Now I either spend or hoard.” But life is more like a slope—flexible, unpredictable. The mistake is committing fully to one story without adjusting as you go.

Christine Benz

Spending too fast often happens when people don’t have a plan. But spending too little is emotional deprivation—it’s rooted in scarcity. We help people find confidence in a plan that supports both early life and longevity.

Dr. Laura Carstensen

People who hoard money into their 80s often say, “Now it’s too late.” That’s emotional loss, not just financial. But overspending early, especially from fear of missing out, can lead to guilt and dependence later. Balance is the unsung virtue.

Bill Perkins

The biggest danger is regret—either way. You can recover money. You can’t recover time. I say: spend earlier, yes, but also spend smarter. Travel light. Maximize moments. That’s how you die with zero and live with plenty.

💬 Kara: How can people find peace with their spending—without feeling like they’ll either miss out or run out?

Dr. Laura Carstensen

Know what really fulfills you. It’s often simpler than you think. People feel peace when they see their money aligned with meaning—not with status or security alone.

Christine Benz

Segment your retirement. Plan a “go-go” phase where you intentionally spend more on what energizes you. Then adjust later. Having a structured vision gives peace to both the spender and the saver inside you.

Morgan Housel

Peace comes from ownership of your choices. Not copying a retirement formula, but making your own trade-offs. When you’ve thought deeply about the time vs. money equation, regret fades—even if your plan isn’t perfect.

Ramit Sethi

Do a “Rich Life” audit. Ask: what do I want to feel, experience, give, and remember? Then build a spending plan around those. Not a budget—a joy map.

Bill Perkins

Put joy on the calendar. Don’t wait for “someday.” If it matters, schedule it. Money can’t buy time—but it can buy memories in the time you have.

🌟 Kara Swisher (final thoughts)

What we’re really talking about here isn’t just money. It’s time. It’s health. It’s meaning.

Spend early? Sure—if you do it with clarity. Save for later? Absolutely—if you do it without fear.

But most importantly: don’t make decisions by default. Make them by design. Because a rich life isn’t about what you keep. It’s about what you live.

Topic 4: Can Low-Income Retirees Delay Social Security? The Hidden Inequity

Moderator: Tara Siegel Bernard – New York Times journalist covering retirement and middle-class financial struggles

Panelists:

Alicia Munnell – Director, Center for Retirement Research at Boston College

Teresa Ghilarducci – Economist, retirement inequality expert

Dorian Warren – President, Center for Community Change

Nancy Altman – Co-founder of Social Security Works

Linda Garcia – Latina financial educator and founder of In Luz We Trust

🌟 Tara Siegel Bernard (opening remarks)

Let’s talk about a truth too often ignored in the Social Security conversation: not everyone gets to “choose” when to claim. Low-income workers, people of color, women—many claim early not because it’s optimal, but because they’re out of options. Today we ask: Is the system fair? Is claiming early a privilege or a trap? And what can be done to make this critical decision more equitable?

💬 Tara: More than half of retirees claim Social Security before full retirement age. Why is early claiming so common—especially among low-income workers?

Alicia Munnell

It’s simple: people retire when they must, not when they want. Physically demanding jobs, poor health, and lack of employer retirement plans leave little choice. For many, Social Security is the only lifeline. They claim at 62 because they can’t afford not to.

Dorian Warren

Wealth inequality is deeply racialized. Black and Latino workers are more likely to have unstable jobs, caregiving burdens, and shorter life expectancies—yet they receive the same or even fewer benefits. Claiming early isn’t a strategy. It’s survival.

Linda Garcia

In my community, claiming early feels like taking back control. But no one tells us the long-term cost. Many first-gen retirees don’t realize that taking Social Security early locks them into a lower income for life. It’s a hard pill, especially when every dollar matters.

Nancy Altman

Social Security was designed to protect the most vulnerable. But when people are forced to claim early due to structural inequality, we’ve failed that mission. We need to treat early claiming not as a choice, but as a symptom of a broken system.

Teresa Ghilarducci

Let’s not sugarcoat it: Retirement is a class privilege. Without strong unions, pensions, or universal 401(k)s, millions face the brutal reality of working into old age—or claiming early and living in poverty. This isn’t about math. It’s about justice.

💬 Tara: Is it realistic—or even ethical—to encourage low-income Americans to delay claiming when they’re already financially stressed?

Nancy Altman

Not without fixing the root problems. You can’t ask someone to delay claiming while offering no bridge income, no job security, and no healthcare. If we want people to delay, we must enable them to delay—through policy, not platitudes.

Alicia Munnell

We can suggest delay, but only with context and compassion. For some, delaying even a year can boost benefits noticeably. But the idea of “waiting until 70” is a fantasy for the working poor unless we provide new tools: wage subsidies, early retiree support, and better education.

Linda Garcia

We need to change the narrative. “Delay if you can” sounds different from “You’re making a bad decision.” We must honor survival choices while offering support for those who might barely be able to wait—if they had just a little help.

Teresa Ghilarducci

Delaying is only ethical when backed by infrastructure: guaranteed jobs, phased retirement, universal basic income, or transitional support. Otherwise, you’re telling someone with no safety net to wait on a cliff’s edge.

Dorian Warren

Let’s be real. Telling someone living paycheck to paycheck to delay Social Security is like telling someone who’s drowning to “hold your breath longer.” If we don’t change the conditions, we can’t change the outcomes.

💬 Tara: What reforms or community efforts could make Social Security more equitable for those forced to claim early?

Teresa Ghilarducci

Start with auto-enrollment in retirement plans, wage credits for caregivers, and removing penalties for part-time workers. Then consider a higher minimum Social Security benefit—so early claimers aren’t punished forever for systemic disadvantages.

Nancy Altman

Social Security Works supports increasing benefits across the board and eliminating the retirement earnings test before full retirement age. People should not be penalized for working after claiming. And let’s tax the wealthy fairly to fund it.

Dorian Warren

We need community-centered education. Meet people where they are: churches, barbershops, ESL classes. Let’s demystify the claiming process and help folks make informed decisions without shame. Knowledge is power—so put it in people’s hands.

Linda Garcia

In Luz We Trust is doing this now—teaching Latinas about claiming strategies in Spanglish, with cultural context. One solution? Micro-grants or local “delay funds” to help people wait even just 6 months longer. Sometimes that’s all it takes to shift the math.

Alicia Munnell

We must also talk about life expectancy equity. Reform the benefit formula so those with shorter expected lifespans—often low-income earners—aren’t subsidizing those who live to 95. Social Security must reflect real demographic diversity, not averages.

🌟 Tara Siegel Bernard (final thoughts)

For many Americans, Social Security isn’t a cushion—it’s the floor. And when that floor cracks from early claiming, it’s often because the walls of opportunity were never built. It’s time we stop treating early claiming as a mere personal decision—and recognize it as a mirror of economic injustice. Only then can we change both the story and the system.

Topic 5: Should I Use Savings to Delay Social Security Until 70?

Moderator: Jane Bryant Quinn – Legendary retirement finance journalist and author of How to Make Your Money Last

Panelists:

Laurence Kotlikoff – Economist and developer of “Maximize My Social Security” software

Michael Kitces – Financial planner and strategist focused on withdrawal sequencing

Moshe Milevsky – Retirement math expert and longevity insurance scholar

Jonathan Clements – Personal finance author and founder of HumbleDollar

Christine Benz – Morningstar Director of Personal Finance

🌟 Jane Bryant Quinn (opening remarks)

If you’ve saved up a nest egg, here’s the classic dilemma: Do you tap your savings first and delay Social Security—or claim early to preserve your portfolio? One promises higher guaranteed income later; the other offers short-term security. But what’s the right move for someone trying to survive and maximize? Let’s dive in.

💬 Jane: If someone has modest retirement savings, should they use that money first and delay Social Security, or claim early and preserve their assets?

Michael Kitces

It’s counterintuitive, but often the best move is to spend down savings first and delay Social Security. Why? Because Social Security is longevity-protected, inflation-adjusted, and guaranteed. In contrast, your savings are vulnerable to market swings and bad timing. Delaying builds a stronger income floor later.

Jonathan Clements

I agree. Drawing down savings while delaying Social Security front-loads your risk, but it lowers long-term risk dramatically. It’s a trade: give up portfolio balance now for lifetime income later. The key is having the discipline to follow through.

Laurence Kotlikoff

My software shows that for many middle-income households, delaying to 70 can increase lifetime spending power dramatically. Even modest drawdowns from savings to “buy” those higher benefits can make a big difference. But it must be modeled precisely—don’t guess.

Christine Benz

The exception is those who are terrified of seeing their balances shrink. Emotional risk tolerance matters. If drawing down savings causes sleepless nights, then claiming early might be more sustainable—even if it’s suboptimal on paper.

Moshe Milevsky

Think of delaying as purchasing annuity-like income from the government. It’s one of the best longevity hedges available. If you can self-fund a delay—even for just a few years—it can radically reduce the chance of running out of money in your 80s or 90s.

💬 Jane: What are the biggest risks in choosing to claim early—even if you think you “don’t need the money yet”?

Laurence Kotlikoff

The biggest risk is regret at age 82. People forget: claiming early means locking in a permanently smaller check. If inflation spikes, health costs rise, or your portfolio underperforms, early claimers can feel squeezed—and there’s no “undo” button past the first 12 months.

Moshe Milevsky

Early claiming exposes you to sequence-of-return risk. If markets drop early in retirement while you're withdrawing from savings AND getting lower Social Security benefits, you could deplete assets faster than expected.

Christine Benz

People underestimate how long they’ll live. Especially for women, who often outlive their spouses and may have lower personal benefits, delaying can significantly improve later-life security. Claiming early to preserve savings may feel conservative—but it’s often the riskier move long-term.

Jonathan Clements

Many assume they’ll invest their early benefits and grow them. Few actually do. Most spend them. Social Security isn’t just about now—it’s about your future self. If that version of you had a vote, would they say “Thanks” or “Why didn’t you wait?”

Michael Kitces

There’s also the tax trap. Early benefits, if combined with part-time income or IRA withdrawals, can trigger hidden taxes and Medicare premium hikes. Delaying benefits gives you more room to do tax-efficient Roth conversions in the early retirement years.

💬 Jane: For those with enough savings to “play it either way,” how can they make a confident, balanced decision?

Christine Benz

Think in terms of income layers: what do you need to cover your basics (housing, food, healthcare)? Social Security is ideal for that. If delaying helps build a bigger safety layer, do it. If your portfolio can cover “fun money,” that’s a healthier split.

Moshe Milevsky

Run personalized simulations. Use probability—not guesswork. Consider your spouse’s benefit too, because delaying the higher earner’s benefit often helps both. Don’t just compare “early vs. late”—model what happens at age 80, 85, 90.

Jonathan Clements

Ask: what makes me feel free? For some, that’s higher income at 70. For others, it’s knowing their cash won’t run out. Pick the path that minimizes your future financial anxiety, not just maximizes lifetime dollars.

Michael Kitces

If you can delay even to age 67 (full retirement age), you’re often getting the best of both worlds. You give your benefits time to grow, but avoid the steep penalties of claiming at 62. That alone can create a more sustainable income stream.

Laurence Kotlikoff

Run the numbers. Do the math. But above all, make the decision on purpose, not by default. If you’re claiming early because “that’s what everyone does,” you may be leaving tens of thousands of dollars on the table.

🌟 Jane Bryant Quinn (final thoughts)

Too many retirees think they’re choosing between now and never—but the real decision is between now and later. If you have savings, you have options. Spend a little now to gain a lot later. The best strategy may not be the flashiest—it’s the one that helps you sleep soundly at 85. Choose wisely, and choose with your future in mind.

Topic 6: Will Social Security Still Be There? What to Know Before You Claim

Moderator: Ali Velshi – MSNBC economic journalist known for translating complex policy into clear, accessible conversation

Panelists:

Stephen Goss – Chief Actuary, Social Security Administration

Andrew Biggs – Senior Fellow, American Enterprise Institute

Olivia Mitchell – Professor of Insurance & Risk Management, Wharton

Mark Miller – Retirement columnist and author of Retirement Reboot

Nancy Altman – President, Social Security Works

🌟 Ali Velshi (opening remarks)

Social Security is often described as “safe,” but anxiety looms. People wonder: Will it still be there for me? Will benefits be cut? Should I claim early just in case? With trust declining and politics heating up, this final conversation tackles the biggest question: Is Social Security secure—or on shaky ground?

💬 Ali: Many people say they claim early because they “don’t trust the system will be around.” Is that fear valid—or misplaced?

Stephen Goss

It’s a fear based more on headlines than on math. Yes, the trust fund is projected to be depleted by the mid-2030s, but even then, payroll taxes will still fund about 80% of scheduled benefits. That’s a shortfall—not a collapse. The system isn’t disappearing.

Olivia Mitchell

The concern is valid—but maybe misdirected. The issue isn’t if Social Security will vanish, but whether Congress will act in time to adjust. It’s not about the program failing—it’s about political will. The earlier we act, the gentler the fix.

Nancy Altman

That fear is being intentionally stoked to weaken support for expanding benefits. Social Security is the most successful and trusted program in U.S. history. It’s not bankrupt, and we don’t need cuts—we need the wealthy to pay their fair share.

Andrew Biggs

I’ll be frank: benefits will likely need to be restructured. Whether that’s raising the full retirement age, reducing cost-of-living adjustments, or means testing, some reform is coming. Delaying action only narrows the options. Fear is understandable—but reform is manageable.

Mark Miller

When people say “I don’t trust it,” I ask: Do you trust future governments to cut retirees’ checks dramatically? That’s politically toxic. Benefits may be tweaked, but they won’t vanish. Claiming early out of fear is like abandoning your umbrella because you heard it might rain.

💬 Ali: What are the most realistic reforms we’re likely to see—and how should that affect someone’s claiming decision?

Andrew Biggs

Raising the retirement age is the low-hanging fruit. It doesn’t affect current retirees, but gradually shifts expectations for younger generations. We may also see reduced benefits for higher earners—means testing will likely be part of the mix.

Nancy Altman

We should expand benefits, not cut them. That means lifting or eliminating the payroll tax cap so millionaires pay into the system at the same rate as working-class Americans. Most people support this. It’s a question of values, not affordability.

Stephen Goss

Reform is coming, but there’s time. The sooner lawmakers act, the smaller and smoother the changes will be. People in their 60s today are unlikely to see dramatic cuts. For most, that fear should not dictate their claiming strategy.

Mark Miller

The best advice? Plan based on the current law, but stay informed. If you’re 62 today, the benefits you see are very close to what you’ll get. If you’re 35, expect some changes. But don’t let political speculation drive major life decisions.

Olivia Mitchell

Young workers may need to diversify more—Social Security alone won’t be enough. But for boomers and Gen Xers, the structure will largely hold. Claiming early purely out of fear isn’t a good strategy—especially when that fear is exaggerated.

💬 Ali: So how should people balance trust, skepticism, and action when deciding when to claim?

Mark Miller

Trust the math, not the noise. Your claiming decision should reflect your health, resources, and needs—not fear that the sky is falling. If you claim early because you must, that’s one thing. But fear alone shouldn’t steal your future income.

Olivia Mitchell

It’s healthy to be skeptical—but not fatalistic. Make your decision with awareness, not cynicism. Look at worst-case planning, but don’t make your only plan the doomsday scenario. Financial planning is about adaptive optimism.

Nancy Altman

We don’t just need individual action—we need collective action. Vote like your retirement depends on it. Call your reps. Support policies that protect and expand Social Security. It’s not just about trusting the system—it’s about shaping it.

Andrew Biggs

Be proactive. Use retirement calculators that include benefit adjustment scenarios. Prepare for the possibility of reform, but don’t assume collapse. Fear is not a financial plan—resilience is.

Stephen Goss

Stay grounded. Social Security is built to evolve. Reforms are inevitable—but so is its survival. If you delay benefits for higher income later, you’re not taking a risk—you’re betting on a program that’s proven itself for 90 years.

🌟 Ali Velshi (final thoughts)

Social Security is both stable and shifting. It’s not perfect, but it’s persistent. Don’t let political noise drown out personal clarity. Ask what you need to feel secure—not just today, but decades from now. And remember: the system’s future is not written in stone. It’s written in laws—and laws can be changed.

Final Thoughts by Jane Bryant Quinn

(Using calm authority, grounded insight, and SEO-smart phrasing)

There’s no single best age to claim Social Security—only the age that’s best for you.

The most common question I hear is, “Should I claim at 62 or delay?” And my answer is always the same: That depends on your health, your savings, and your peace of mind.

If you’re healthy and can afford to wait, delaying may give you the safest—and highest—income for life. But if your finances are tight or you simply need the money, claiming early is not failure. It’s survival, and there’s no shame in that.

And to the question I’ve heard for decades—“Will Social Security still be there?”—yes, it will. The rules may shift. The formulas may change. But the promise won’t disappear. If you’re close to retirement now, your benefits are more secure than the headlines suggest.

So take a breath. Run your numbers. Talk to someone who sees the whole picture. Then make your decision not out of fear—but out of clarity, courage, and care for your future self.

Short Bios:

Jane Bryant Quinn:

Veteran financial journalist and author of How to Make Your Money Last, Jane is one of the most trusted voices in retirement planning, known for her clear, compassionate guidance.

Suze Orman:

Personal finance expert and best-selling author who has helped millions navigate retirement decisions, with a strong emphasis on emotional clarity and long-term financial security.

Ramit Sethi:

Author of I Will Teach You to Be Rich, Ramit focuses on behavioral finance and encourages people to align money choices with personal values and lifestyle goals.

Daniel Kahneman:

Nobel Prize-winning psychologist and pioneer of behavioral economics, his work explored how fear and cognitive biases affect financial decision-making.

Terri Trespicio:

Writer and speaker on personal empowerment, she brings a wellness and mindset lens to financial choices, especially around guilt, scarcity, and emotional self-worth.

Laurence Kotlikoff:

Economist and creator of Maximize My Social Security software, known for his precision modeling and advocacy for optimal claiming strategies.

Wade Pfau:

Retirement researcher and professor of financial planning, specializing in sustainable withdrawal strategies and the role of Social Security in risk management.

Dr. Peter Attia:

Longevity physician and author focused on maximizing lifespan and healthspan through proactive, data-driven lifestyle choices.

David Sinclair:

Harvard aging researcher and biotech innovator, widely recognized for his work on extending healthy lifespan and its implications on retirement timelines.

Bill Bengen:

Financial advisor and creator of the 4% retirement withdrawal rule, a key voice in safe withdrawal rates and long-term planning.

Jonathan Clements:

Former Wall Street Journal columnist and founder of HumbleDollar, known for his accessible writing on retirement, saving, and smart financial behavior.

Christine Benz:

Director of Personal Finance at Morningstar, she offers practical strategies for integrating Social Security into holistic retirement planning.

Alicia Munnell:

Director of the Center for Retirement Research at Boston College, and one of the foremost authorities on retirement readiness and Social Security policy.

Teresa Ghilarducci:

Economist specializing in retirement inequality, labor, and public policy, with a focus on improving outcomes for low- and middle-income workers.

Dorian Warren:

Community organizer and president of the Center for Community Change, advocating for economic justice across race, gender, and class.

Nancy Altman:

President of Social Security Works and a long-time defender of the program, she champions expansion and equity in retirement benefits.

Linda Garcia:

Founder of In Luz We Trust, she educates the Latino community on finance with cultural awareness, helping first-gen families build wealth and agency.

Michael Kitces:

Financial planner and educator, widely respected for his deep analysis of tax-efficient retirement strategies and Social Security optimization.

Moshe Milevsky:

Finance professor and expert on longevity insurance, known for his research on retirement risk, annuities, and optimal financial timing.

Mark Miller:

Journalist and author of Retirement Reboot, offering practical advice on timing, policy, and the emotional side of retirement planning.

Stephen Goss:

Chief Actuary of the Social Security Administration, responsible for forecasting the financial future of the system and assessing reform needs.

Andrew Biggs:

Senior Fellow at the American Enterprise Institute, specializing in Social Security reform and policy modeling from a conservative fiscal viewpoint.

Olivia Mitchell:

Wharton School professor and international expert in pensions and risk management, with deep insight into global and U.S. Social Security systems.

Ali Velshi:

Economic journalist and MSNBC anchor known for making complex economic and financial issues accessible to broad audiences.

Leave a Reply